When you read a lot of points and miles blogs (including our own) you can feel the disappointment in the author’s words when there are devaluations to loyalty programs. It becomes big news when there are significant changes to redemption amounts. This was recently witnessed as some high end Marriott hotels are now requiring up to 150,000 points per night – up from 100,000 or 120,000. That’s a huge jump and definitely newsworthy.

But what I am not seeing much discussion on is some of the great value I’m finding in programs like Marriott Bonvoy for redemption options at everyday hotels. You know, the hotels that most of us actually look at for redeeming at since we aren’t in the small percentage of members who are jetting off to the Maldives, Mauritius or Tahiti.

I’m talking about right here in our own backyard. Where do the majority of Canadians travel? Within Canada, whether it’s a one night getaway in or out of the city or a week long family visit in the next province over, domestic travel is number one. And a program like Marriott Bonvoy can help you save on those domestic travel costs.

Cash rates at Canadian hotels are rising, points rates not so much

With travel reaching or exceeding pre-pandemic levels and inflation creating higher costs, I have seen hotel prices rising significantly across Canada. Whether it is a Courtyard by Marriott or The Ritz-Carlton the cash prices being charged are definitely higher than ever. However, outside of some high end locations in the biggest cities, I haven’t seen point pricing rising as significantly as cash prices with the Marriott Bonvoy program. I believe the same goes for other hotel chains but with Marriott having the biggest footprint in Canada and also as the largest hotel loyalty program here, it is the barometer for our market.

Marriott Bonvoy provides great value

It is those rising cash rates versus points rates that make the Marriott Bonvoy provide really good value for everyday hotel stays. In fact, based on what I have seen I am pretty confident in valuing Marriott Bonvoy points at a minimum of 1 Canadian cent each again. For a while there I was giving it a range of 0.7 cents to 1 cent but I feel most people should be able to get at least 1 cent per point, if not more. Of course, this will totally vary by person, by location, by date and so on. So what I value it at may not be the same as you but it does provide a general benchmark to compare against other programs and to put a relative figure on credit card spending.

Author’s note: While researching the piece for the examples that follow, I actually had a hard time finding free nights with a value below 1 cent per point. Of course, I didn’t check all of the near 300 hotels in Canada but probably ended up looking at 70-80 hotels and for the most part they were all at 1 cent or higher. There was one notable exception where I did see lower value for points and that was the Niagara Falls region in August. The cash rates versus points rates were definitely well below 1 cent per point.

Examples of Everyday Value at Canadian Marriott Hotels

Here are some examples of the value you can find at everyday hotels across Canada when using Marriott Bonvoy points:

Vancouver

Maybe you need to stay overnight at a hotel near Vancouver airport before flying out early the next day during the height of the summer season. Well, hotel cash prices are outrageously stupid in the area (and across Canada in general) but points can be used to come to your bank account’s rescue. Here’s the Four Points by Sheraton Vancouver Airport on July 18 which happens to be a PointSavers night:

Here you can use 30,400 points to cover the complete cost of $431. That’s a value of 1.4 cents per point – not bad at all, I mean it is 40% higher than our minimum point valuation for the program.

Okanagan

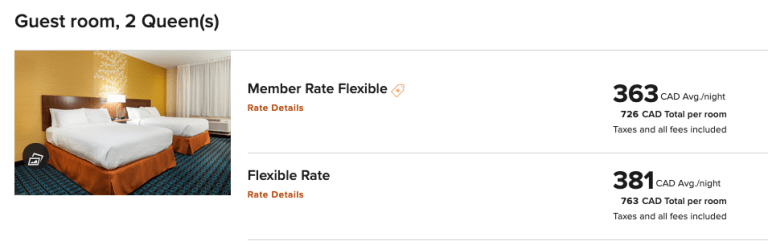

Visiting the grandparents in Vernon B.C. for May long weekend? Here’s Friday and Saturday night (May 19/20) at the Fairfield Inn & Suites Vernon

Here you can use 45,000 points to cover a $726 hotel stay. That provides a very respectable value of 1.6 cents per point. And this highlights just how crazy hotel cash pricing has become. $726 for two nights at a Fairfield Inn??? But that seems to be the going rate for a busy long weekend in the Kelowna area!

Speaking of Kelowna, perhaps you want to be right in the heart of all the action during May long? That’s a busy time and prices are sky high but the value is still there at the Delta Hotels Grand Okanagan Resort on those same two nights:

Here you can use 117,000 points +$67.80 for resort fees to cover a $1730 hotel stay. Once again we have value higher than my 1 cent minimum as this redemption comes in at 1.42 cents per point.

Alberta

Ready to get your cowboy gear on as you hit up the Calgary Stampede? Here are two examples of five night stays from July 10 to 15 in the city during Stampede. One location not too far away from Stampede grounds and another that is further out where you would have to drive or take transit.

If you are not familiar with the Marriott Bonvoy program, five nights is significant as you get one night free when you redeem points for a five consecutive night stay (the lowest points price night is the one that is free) and this boost your points value even higher.

Here’s five nights at The Westin Calgary Downtown:

Here you can use 140,000 points (4 nights at 35,000 points, 5th night free) to cover a $5,074 hotel stay. This redemption provides an amazing value of 3.6 cents per point. I’ll appease the nay sayers here by stating that yes, one must consider if you would actually be willing to pay $5,074 for 5 nights during Stampede and I think most of us would not be willing to do so – but that’s what hotels (at least nice hotels) in downtown Calgary are charging so some people must be willing to pay that price. More realistically you could have a budget where you are willing to spend $500 per night and if that’s the case those 140,000 points would still be worth 1.79 cents apiece.

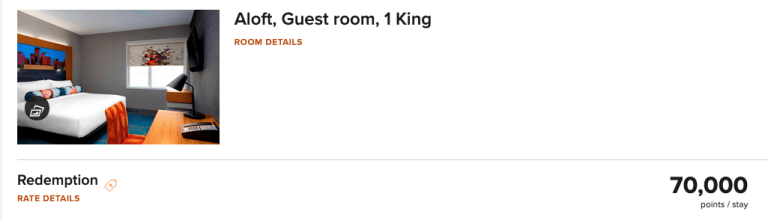

Now let’s go to a more reasonably cash priced hotel for the Stampede, The Aloft Calgary University. It’s right by a C-Train station so it provides easy transit access to the Stampede grounds:

Here you can use 70,000 points for five nights (4 nights at 17,500 points, 5th night free) to cover a $2,181 hotel stay. Another big time value redemption of 3.11 cents per point!

Maybe you need to head north of Calgary for a quick overnight trip in Edmonton toward the end of April? How about the Four Points by Sheraton Edmonton South:

Only 9,000 points for a night here (this is a Friday night) and the cash rate including all taxes and fees is $154. Again, really good value at 1.7 cents per point!

Road Trip Across Canada Anyone?

Maybe you’re planning to drive across Canada in August? There are some great hotels you can overnight at for not a lot of points:

You could overnight in Saskatchewan at the Fairfield Inn & Suites Regina for only 11,500 points on August 10:

You can keep $196 in your pocket for those 11,500 points. Here you have value at 1.7 cents per point!

Next up on your road trip after 13 to 14 hours of driving, perhaps Thunder Bay? You can stay at the very nice Delta Hotels Thunder Bay:

Here you are looking at 1.58 cents of value when you redeem 22,500 points for that $356 hotel room.

Now, you’ve decided that as part of your cross Canada road trip you want to take the kids to Canada’s Wonderland in the Greater Toronto Area. So you make the 14-15 hour drive and stay at the Courtyard Toronto Vaughan on August 13:

Only 19,000 points for a $361 room or 1.9 cents per point in value.

Now, I’m going to stop the example part of the post here – when I started to research it and write it I didn’t plan for this road trip section. It kind of just came naturally as I wrote the post and I had a fun time doing it but it has made it as long, if not longer than I wanted.

I think from the above examples you get the idea that I am trying to get across and don’t need me to provide any further options. With nearly 300 hotels from coast to coast, Marriott has something for everyone and you can see the everyday value in the program.

That brings us to the point where you may be asking: how do I go about earning Marriott Bonvoy points? And that’s what comes next!

Best ways to earn Marriott Bonvoy Points

For Canadians you can earn points when you stay at Marriott Hotels (from 5 to 10 points per US$ equivalent), buy Marriott Points when they have a bonus or rent cars with Hertz but by far and away the easiest is earning them via credit card spending. Thanks to Marriott Bonvoy’s partnership with American Express there are numerous avenues to earn points and you can rack them up fast with these cards.

The first two cards are the actual Marriott co-brand cards offered by American Express. These cards earn Bonvoy points directly and those points post to your Marriott Bonvoy account a few days after your statement date.

Marriott Bonvoy American Express Card

- New Marriott Bonvoy® American Express®* Cardmembers earn 50,000 Marriott Bonvoy® points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership. Subject to change at any time

- $120 annual fee

- Earns 5 Bonvoy Points per dollar on Marriott purchases

- Earns 2 Bonvoy Points per dollar on all other purchases

- Automatic Silver Elite Status

- Annual free night award up to 35,000 points

- Click here to learn more and/or to apply for this card

Marriott Bonvoy Business American Express Card

- Earn 60,000 Welcome Bonus Marriott Bonvoy® points after you spend $5,000 on your Card in your first three months of Cardmembership.

- $150 annual fee

- Earns 5 Bonvoy Points per dollar on Marriott purchases

- Earns 3 Bonvoy Points per dollar on gas, dining and travel purchases

- Earns 2 Bonvoy Points per dollar on all other purchases

- Automatic Marriott Bonvoy Silver Elite Status

- Annual free night award up to 35,000 points

- Click here to learn more and/or to apply for this card

The 50,000 or 60,000 point bonus from either of these two cards would cover the entire road trip example given above. As you have to spend $1,500 to get the welcome bonus you would end up with no less than 53,000 points (2 points per dollar) The nights in Regina, Thunder Bay and Vaughan some how come to a total of 53,000 points as well (Believe me, I did not plan this! It came as a surprise to me when I added it all up) That’s not a bad welcome bonus offer to get three nights worth $913!

Also these card’s base earn rate of 2 points per dollar gives you at least a 2% return which very few cards in our market can match. In fact, based on the examples above the base earn rate provides a 2.8% to 7.2% return!

The next cards are Amex’s own proprietary rewards cards. These cards earn Membership Rewards points and those points can be converted to Marriott Bonvoy points at a 1 to 1.2 ratio. Unlike the Bonvoy cards, Membership Rewards points post as soon as a charge posts to your account so they are available sooner. When you do choose to transfer to Marriott it can take up to 48 hours for the points to show up in your Bonvoy account.

American Express Cobalt Card

- 15,000 points welcome bonus (Min. spend $750 per month for 12 months) = 18,000 Bonvoy Points

- $12.99 monthly fee

- Earns 5 Membership Rewards points per dollar on eats and drinks = 6 Bonvoy Points per dollar

- Earns 3 Membership Rewards Points per dollar on select streaming services = 3.6 Bonvoy Points per dollar

- Earns 2 Membership Rewards Points per dollar on gas, travel, transit = 2.4 Bonvoy Points per dollar

- Earns 1 Membership Rewards Point per dollar on all other purchases = 1.2 Bonvoy Points per dollar

- Click here to learn more or to apply for this card

This is the card you would look at if you want to turbocharge your everyday Marriott points earning. With the equivalent of 6 Bonvoy points per dollar on groceries, dining, coffee shops and so on, the Cobalt Card can really rack up the points quickly. If you take some of the examples from above those 6 points per dollar work out to 8.4% to a 21.6% return on your eats and drinks spending! (1.4 to 3.6 cents per point)

The Platinum Card from American Express

- 100,000 points welcome bonus (Min. spend $10,000 in first three months) = 120,000 Bonvoy Points

- $699 Annual Fee

- Earns 2 Membership Rewards Points per dollar on dining = 2.4 Bonvoy Points per dollar

- Earns 2 Membership Rewards Points per dollar on travel = 2.4 Bonvoy Points per dollar

- Earns 1 Membership Rewards Point per dollar on all other purchases = 1.2 Bonvoy Points per dollar

- Automatic Marriott Bonvoy Gold Elite Status

- Click here to learn more or to apply for this card

This card is the one to look at if you want a big chunk of Marriott Bonvoy points quickly (and Marriott Gold Elite status for that matter). In 3 months or less you could have 130,000 Bonvoy points with this card. This comes from the 100,000 point bonus plus at least 10,000 more Membership Rewards points for your spending requirement. As Membership Rewards points post quickly, including the welcome bonus, the sooner you can spend that $10,000, the sooner you can have those Bonvoy points.

American Express Gold Rewards Card

- 60,000 points welcome bonus (Min. spend $1,000 per month for 12 months) = 72,000 Bonvoy Points

- $250 Annual Fee

- Earns 2 Membership Rewards Points per dollar on travel, gas, groceries, drug stores = 2.4 Bonvoy Points per dollar

- Earns 1 Membership Rewards Point per dollar on all other purchases = 1.2 Bonvoy Points per dollar

- Click here to learn more or to apply for this card

This card could be a consideration if you don’t want to dish out $699 for the Platinum Card (but educate yourself on the Platinum Card to see all the benefits and value you get for that $699) In terms of Marriott Bonvoy however I would probably skip this card and go for the Cobalt Card. The only situation where this card would make sense for Marriott Bonvoy is if you have a lot of drug store purchases.

American Express Green Card

- 10,000 points welcome bonus (Min. spend $1,000 in the first three months) = 12,000 Bonvoy Points

- $0 Annual Fee

- Earns 1 Membership Rewards Point per dollar on all purchases = 1.2 Bonvoy Points per dollar

- Click here to learn more or to apply for this card

This is the card to get if you want a no fee card that can earn Marriott Bonvoy points. Some people just don’t like to pay annual fees so if that is you this is your card. Or, perhaps you are just starting out with credit (a student, new to Canada etc) this card is your foot in the door with Amex and the Marriott Bonvoy program. Then, once you are more established you can move up to one of the fee based cards.

Tip:

You can run with multiple cards if you want to earn more points and avail from more benefits. One example would be to have the American Express Cobalt Card with the Marriott Bonvoy American Express Card. The Marriott card gives you the additional Marriott benefits plus would be used for Marriott purchases and any purchases where the Cobalt Card would only earn 1 point. All other purchases would go on the Cobalt Card for its higher earn rates. (The Rewards Canada family does exactly this – plus we also have the Platinum card which provides the Marriott Gold Elite status)

Speaking of benefits from the Marriott Bonvoy American Express cards, the most famous and considered by many as the most valuable benefit is the annual free night award! You can learn more about that in this post:

10 great hotels in Canada to use your Marriott Amex free night award at

Wrapping it up

There has been a lot of ‘negative press’ surrounding the Marriott Bonvoy program in regards to them moving to dynamic pricing and far-away dream locations seeing increases upwards of 50% for free nights. However, closer to home I feel the program requires some ‘positive press’. There is a lot of value to be had from Marriott Bonvoy and other hotel loyalty programs for Canadians from all walks of life. As hotel prices skyrocket the value of hotel loyalty programs has increased as well. To be able to use them to soften the blow to your wallet for stays close to home makes just as much sense as using them for a trip to some far flung destination.

Click here to learn more about the Marriott Bonvoy program.

Everyday Value Series

This post is part a new series here on Reward Canada entitled Everyday Value. With the Everyday Value series we aim to show how reward programs and credit cards can provide value for the everyday Canadian. The fact is over 90% of travel rewards redemptions are for economy class flights, lower to mid-level hotels, cash back and merchandise. Thus we hope that by developing this series for the majority of Canadians, they will come to enjoy and reap the benefits of reward programs even more than they already are.

Check out the entire Everyday Value Series here

Want to learn more? Have a question? Join our Facebook group to ask the Rewards Canada community!

Be sure to subscribe to the Rewards Canada News email newsletter so that you don’t miss out on any loyalty program news and offers! You can subscribe to the newsletter here

Images via Marriott

This post was in no way sponsored by any of the companies mentioned herein. We do earn affiliate commissions on hotel stays booked with Marriott and credit cards applied for via the links in this post.