This card needs no introduction if you are a RWRDS Canada regular, however we continue to see a lot of new visitors to the site each and every month. So we want to present to those new readers the best credit card in Canada and the one we believe should be in every Canadian’s wallet. That card is the American Express Cobalt® Card and you may be asking why you should have it?

Let’s answer that with a few of the awards and/or phrases we have used for this card over its six year lifespan:

- The Best Travel Rewards Credit Card in Canada (For six years straight)

- One of the best cash back credit cards in Canada

- A points earning machine

- The destroyer

- and the list goes on and on

With everyday earn rates of 1 to 5 points per dollar spent, super flexible travel and cash back redemption options and the ability to transfer 1:1 to Air Canada Aeroplan and British Airways Executive Club, it is the card for everyone to have.

Welcome bonus

Here’s how the welcome bonus offer is structured on the American Express Cobalt Card:

- In your first year as a new Cobalt Cardmember, you can earn 1,250 Membership Rewards® points for each monthly billing period in which you spend $750 in net purchases on your Card. This could add up to 15,000 points in a year

This does not include the points you earn on the actual spending. For example if you simply buy $750 of groceries per month on the card that works out 3,750 points on your spending plus you get the 1,250 welcome bonus points. So after one year, if you did only put $750 worth of groceries per month on your card you would end up with 60,000 points. Of course, if you really wanted to maximize this card you wouldn’t limit yourself to $750 of groceries as you’d also be putting as much of your dining, bar visits, coffee shop visits etc. on this card as well for those 5x points, streaming services for 3x points and so on.

Value from the points

Let’s say you did just stick with $750 a month on eats and drinks, you’d have 60,000 points in your first year which could be redeemed for the following:

- $600 in rewards when redeeming via Use Points for Purchases (the cash back option)

- Four round trip flights on popular short haul Canada/US routes with Amex’s Fixed Points for travel (up to $1,200 in total value)

- Three round trip flights on other short haul Canada/US routes with Amex’s Fixed Points for travel (up to $900 in total value)

- One round trip flights from Canada to Europe with Amex’s Fixed Points for travel (up to $900 in total value)

- 60,000 Aeroplan Points or British Airways Avios (min. $900 in value),

- 72,000 Marriott Bonvoy Points (min. $720 value)

Those are just some of the best redemption options that you can get with this card and offer.

Earn rates

- Earn 5x the points on eligible eats and drinks in Canada, including groceries and food delivery ($2,500 monthly cap)

- Earn 3x the points on eligible streaming subscriptions in Canada

- Earn 2 points for every $1 spent on eligible transit & gas purchases in Canada and eligible travel purchases. That’s 2X the points on purchases that get you from point A to B

- Earn 1 point for every $1 in Card purchases everywhere else.

You’ll want to note, even though it is stated ‘in Canada’ for those earn rates they are in fact available globally. We confirmed this with American Express back when the card launched in 2017 and also have confirmation from our own use and the use of the cards by our readers outside of Canada. In fact, you can see the confirmed locations in Canada and Worldwide in our feature: American Express Cobalt Card Confirmed Multiplier Locations

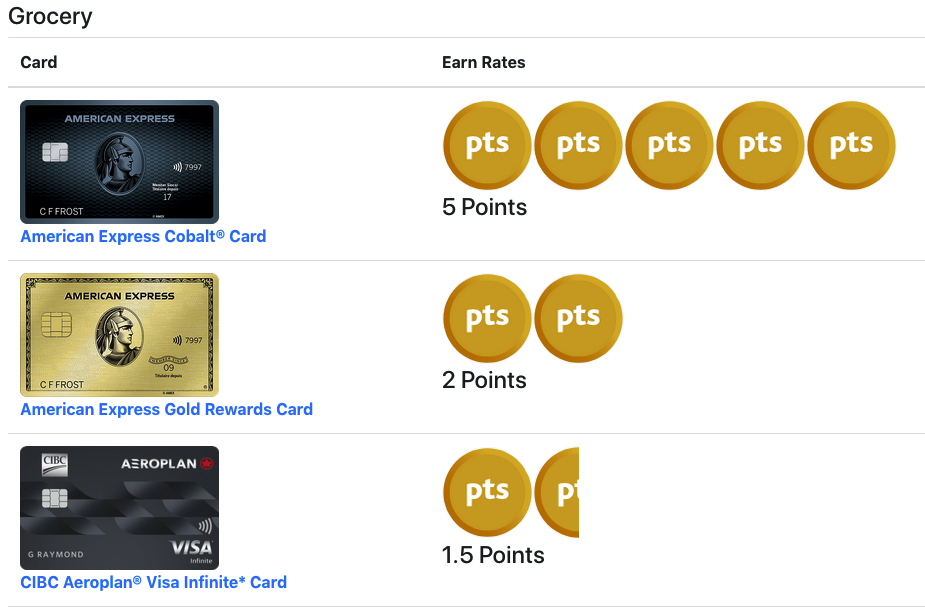

Take note of those earn rates, since you can convert the points to Aeroplan at 1:1 ratio it makes the Cobalt Card the number one card in Canada for earning Aeroplan points. In our feature Which credit card earns the most Aeroplan Points? the Cobalt Card takes and/or ties for top spot in five of seven earn categories.

|

| An example of the Cobalt Card’s Aeroplan earn rates |

Monthly Fee vs. Annual Fee

The card was one of the first in Canada to move away from an annual fee to a monthly fee to fall in-line with the modern monthly subscription style of payments. That monthly fee is $12.99 which works out to $155.88 per year which is higher than this card’s competition who are in the $120 to $150 range. Don’t let that dissuade you however as you can easily make up that fee difference in the points you earn. You’ll also want to know that if you need an additional/supplementary card, they are free with the Cobalt Card whereas many competitors charge $50 or more for those additional cards. So you will end up saving money with the Cobalt Card if you do run with multiple cards.

Redeeming points

The American Express Cobalt Card participates in Amex’s Membership Rewards program which is the best credit card reward program in Canada as it has so many valuable redemption options. You can redeem points for any travel you book with the card, you can redeem points for any purchase you make on the card, you can redeem via Amex’s Fixed Points for Travel and you can convert your points to Air Canada Aeroplan, Air France KLM Flying Blue, British Airways Executive Club, Marriott Bonvoy and numerous other programs.

If you redeem using the Use Points for Purchases option, you will get a $10 credit towards every 1,000 points redeemed for a purchase. This means the purchases you make on food and drinks will equate to a 5% return.

Moving on to the Fixed Points Travel Program, the card provides great value here as well. Being able to earn up to 5 points per dollar means you can be flying for as little as $3,000 in spending on this card and provides up to a 10% return on those food and drink purchases.

Finally, another huge and I mean huge benefit to the redemption side of this card is the ability to convert to Membership Rewards Frequent Traveller participants. As of August 16, 2021 the Cobalt Card gained access to all of American Express’ transfer partners including Air Canada Aeroplan and British Airways Executive Club. This is on top of the hotel transfer partners that card already had. With minimum point values of 1 cent for Marriott, 1.5 cents for Aeroplan and British Airways you are achieving up to a 7.5% return for that 5x points earning. But that’s a minimum – there are so many occasions where you can get 3, 4 or even more cents per points with this programs that puts the Cobalt’s return easily into double digits, We’ve seen the Cobalt’s returns even eclipse 30% when converted to Aeroplan for business class flight redemptions!

Recommended reading: American Express Cobalt™ Card Review

Wrapping it up

When we say the American Express Cobalt Card is the best overall card in Canada we don’t just say it based on the information provided by Amex. We say it from experience as the Rewards Canada family has ran with two American Express Cobalt Card accounts ever since the card launched in 2017.

Between the two we are now well beyond 1 million points earned on our organic everyday spending (no manufactured spending, no card churning) The majority of those points have been earned at the 5x points rate but even some at 3x, 2x and 1x plus a number at 10x points when they ran some promotions early on.

The Cobalt Card has been very rewarding for us and for many of our readers. And it can be very rewarding for you as well – even if you only end up putting 50% of your spending on this card and 50% on another card, you will end up ahead in the points and miles game. (for example, those who shop at Loblaws where Amex isn’t accepted you’ll need a second card).

Click here to learn more and apply for the American Express Cobalt Card